The three measures used to establish home affordability are home prices, mortgage rates, and wages. Here’s a closer look at each one.

1. Mortgage Rates

Mortgage rates shot up to over 7% last year, causing many buyers to put their plans on hold. But things are looking different today as rates are starting to come down. George Ratiu, Senior Economist at realtor.com, explains:

Let’s celebrate some good news. . . . mortgage rates are down. With inflation showing a tangible slowdown, I do expect mortgage rates to follow suit in the months ahead.

2. Home Prices

The second factor at play is home prices. Home prices have made headlines over the past few years because they skyrocketed during the pandemic. When discussing home prices in 2023, Lawrence Yun, Chief Economist at NAR, says:

After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.

3. Wages

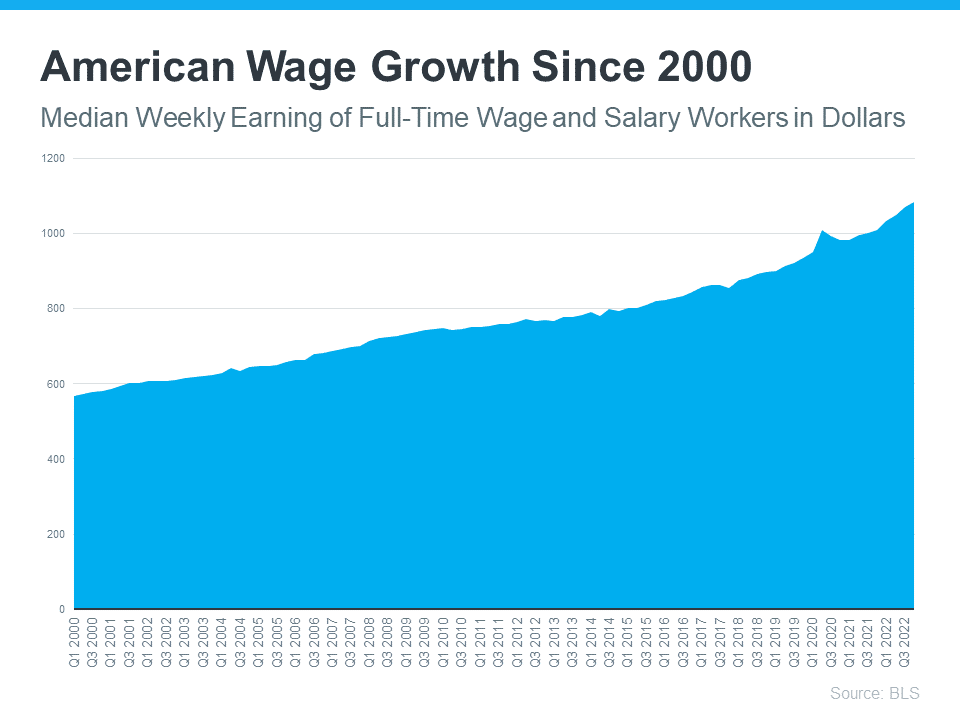

The final component in the affordability equation is wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have increased over time:

When you think about affordability, remember the full picture includes more than just mortgage rates and prices. Wages need to be factored in as well. Because wages have been rising, many buyers have renewed opportunity in the market.

While affordability hurdles are not completely going away this year, based on current trends and projections, 2023 should bring some sense of relief to homebuyers who have faced growing challenges. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), says:

Rates are expected to move lower for the year, and home price growth is expected to cool, both of which will help affordability challenges.

Bottom Line

If you have questions, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your financing options. You may be closer to owning a home than you think.

Comments are closed